are property taxes included in fha mortgage

This calculation only includes principal and interest but does not. As you gain equity in the property FHA cancels mortgage insurance.

Fha Loan What To Know Nerdwallet

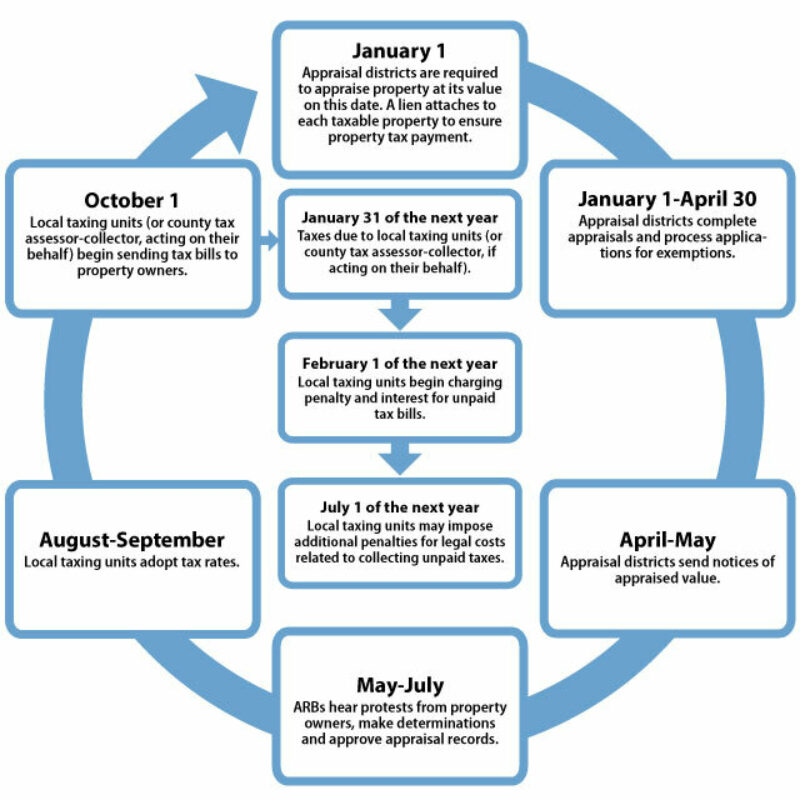

If your home was assessed at 400000 and the property tax rate is 062 you would pay 2480 in property taxes 400000 x 00062 2480.

. Average property tax in California counties. Property Taxes Property taxes are based on the assessed value of the home. Several factors influence this including notably the value of comparable properties in the area.

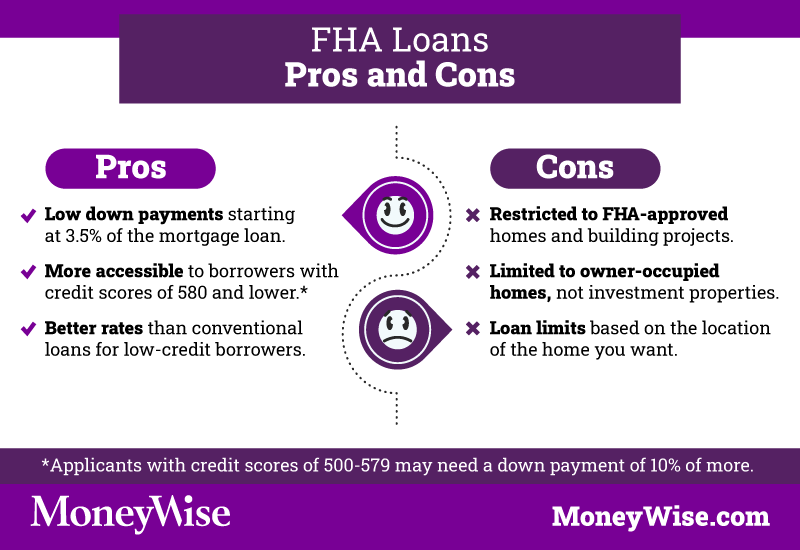

15 and 30 year mortgage terms are most common for fixed rate mortgages. Fha loans require that you escrow for property taxes. Are property taxes included in fha mortgage.

On average counties in Oregon collect 091 of a propertys value in taxes each year. Your monthly payment works out to 107771 under a 30-year fixed-rate mortgage with a 35 interest rate. Thats 167 per month if your property taxes are included in your mortgage or if youre saving up the money in a sinking fund.

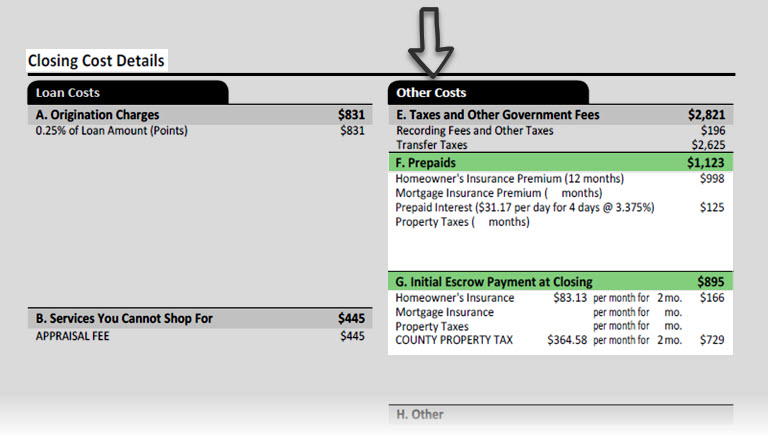

Your closing costs and FHA mortgage interest for example-youll know what these expenses can add up to before you sign on the dotted line. Then FHA Guidelines On. Homeowners in California can repair or remodel a house using one of two types of FHA 203 k rehab loans.

Fha loans require that you escrow for property taxes. Co-op maintenance is composed of the. 1600 12 months 133 per month.

If your mortgage payment included just principal and interest you could. While private lenders who offer conventional loans are usually not required to do that the FHA requires all of its borrowers to pay taxes along with their monthly mortgage. What are fha closing costs.

If you qualify for a 50000. Then are property taxes included in FHA loans. 10 mill levy 10 school.

If you get a home loan through a private lender then technically. To make the property tax process simple and avoid tax penalties Property taxes are included in FHA mortgage payments. The following fees are SOMETIMES included in the APR check.

Property taxes are included as part of your monthly mortgage payment. Your local tax office will take your assessed value and multiply that by your areas tax rate. But property taxes shouldnt be very far down your.

Are property taxes included in mortgage. Updated September 18 2022. Your property taxes are included in your monthly home loan payments.

In Acadia County Louisiana the average. Moreover property taxes are a necessary expense. The Standard 203k is for larger rehab projects over 35000.

You may also choose adjustable rate mortgage which almost always come in a 15. The answer to that usually is yes. From Fannie Maes Selling Guide B2-15-04.

Property taxes are included as part of your monthly mortgage payment. Property taxes included in mortgage. With some exceptions the most likely scenario is that your.

Is Property Tax Included In My Mortgage Moneytips

/text-sign-showing-hand-written-words-fha-home-loan-1179800155-9e745cb5bb5f49279651d7a9e76096ac.jpg)

Federal Housing Administration Fha Loan Requirements Limits How To Qualify

Fha Loans Requirements Limits And Rates Rocket Mortgage

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Fha Loan Calculator Fha Mortgage Payments U S Bank

What Are The Estimated Prepaid Items On An Fha Loan

Fha Multi Family Loan Guidelines For 2022 Fha Lenders

What Is An Fha Loan Complete Guide To Fha Loans Zillow

How To Get A Florida Fha Loan First Time Home Buyers Guide

Fha Loans Everything You Need To Know

All About Property Taxes When Why And How Texans Pay

Article Update What Are The Fha Loan Requirements For Wells And Septic Systems Fha News And Views

Received A Tax Bill And Not Sure What To Do With It A N Mortgage

The Fha Home Loan Process Step By Step Cis Home Loans

/GettyImages-579222810-598e61bf7e094714862cc1ea5e3bb8b3.jpg)